Currently we do not lend money to Self Employed individuals, However if you are interested we can help you contact a third party lender. Kindly leave your query and need on the Contact us page.

You can borrow up to Rs 10,000 at a reasonable market interest with a fixed charge of Rs 150 per Rs 1000 borrowed,

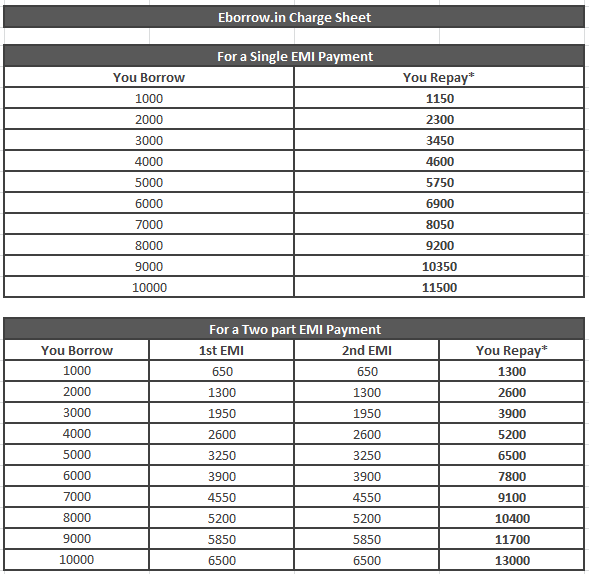

Here is our charge sheet for your understanding:

Absolutely

The Fixed annual interest rate at which Borrower will be charged interest for any day under this agreement is 36% Per Annum. A fixed monthly interest rate of 3% will be charged for the total amount borrowed.

Note: Your total repayment will include documentation / administration charges.

Your loan will be repaid via PDC/EMI details you provided us with when you signed your loan agreement. If you choose to cancel this, you will still owe the full balance and any interest on your account and must provide us with an alternative repayment method to ensure your account does not go in to default, which could in turn, negatively affect your credit rating.

We understand that people's circumstances can change. If this is the case, you must let us know as soon as possible and we will do our best to help. The most important things to note are:

Don't borrow money you don't think you can pay back

Talk to us and we will help as much as possible Please be aware that non repayment by you will result in a bad credit rating. If you default, we may charge you a Late Payment fee of INR 100 per Day after the repayment date. Collection charges and interest on the balance outstanding at the interest rate payable under the agreement. You must pay us any reasonable expenses and costs that we may incur in taking steps to enforce (for example, via Legal enforcements), or attempt to enforce, our rights against you under this agreement. If you are having problems making a payment please contact us on +91 9035016680 or +91 8861537753 and we can discuss your payment options.

There are not hidden charges. We charge Rs 150 per Rs 1000 borrowed. All charges are clearly mentioned & explained in the agreement before you sign the loan agreement.

Yes, there is a late payment fee INR 100 per Day after the repayment date.

Absolutely You can use our Existing Customer login, with your username & password credentials and check your balance at any point of time. You can also use the same portal to reapply for an Eborrow Loan.

You may not postpone you loan repayment at any cost. The maximum repayment period is the repayment date mentioned in the agreement. Please be informed that failing to pay the loan on time will lead to additional charges, poor credit rating in Eborrow books, and legal implications. If you are having problems making a payment please contact us on +91 9035016680 or +91 8861537753 and we can discuss your payment options.

Yes, If you would want to repay the total amount outstanding prior to the end of the loan term, you will have to pay:

(a) The total amount outstanding as at the date of early repayment;

(b) All accrued interest charges to the date of early repayment;

(c) Documentation Fee

If you have any other questions, please Write to us @ info@eborrow.in or Call us on +91 9035016680 or +91 8861537753